Gary Lineker, the ‘chief Twitterer’: does the BBC scandal help or hinder his case?

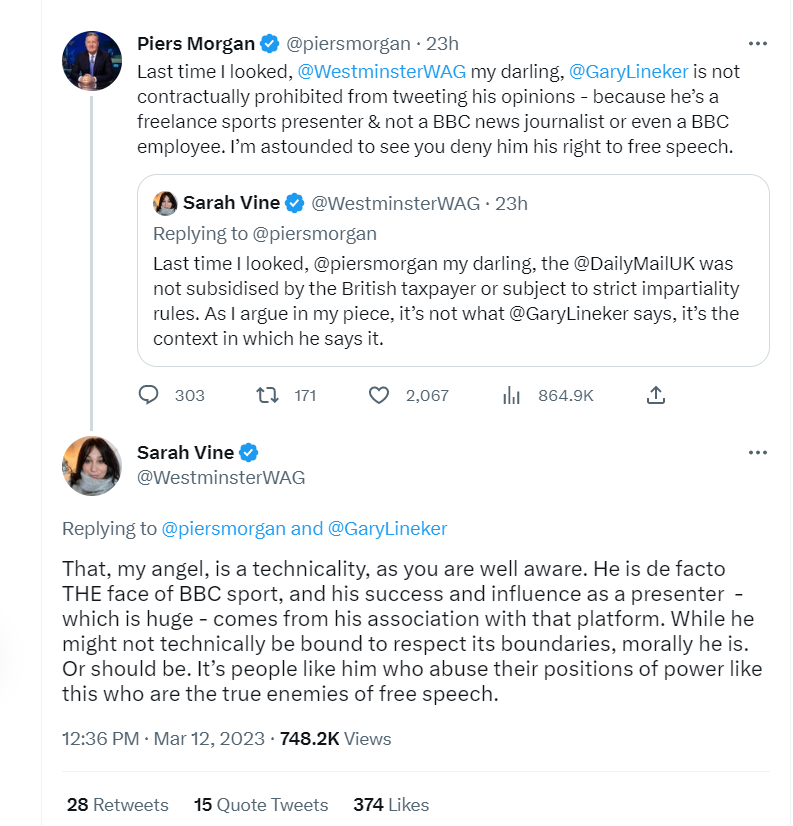

I don’t think a soul has missed Gary Lineker’s short-lived suspension from the BBC. Lineker posted a tweet criticising the language used in the government’s most recent migration policy, where he likened it to the narrative of 1930s Germany.

The BBC suspended Lineker on the basis that he breached their impartiality rules. The disagreement has since been resolved but it poses some essential questions about the nature of freelancing: does this help or hinder Lineker’s IR35 dispute with HMRC?

HMRC have issued Lineker with a bill for £4.9m on the grounds that he’s a ‘disguised employee’ of the BBC, using off-payroll rules to avoid paying the necessary taxes for his employment status. This is an unusual case as Lineker used a partnership rather than the usual situation of a limited company and thus HMRC are still looking to apply the off-payroll legislation.

Lineker’s lawyers are trying to argue that off-payroll rules don’t apply here at all but, rather, the BBC should be the ones liable as the ‘deemed employer’ (under the general rules of self-employment classifications).

Arguably, the level of control the BBC have exercised by suspending Lineker from his post as a result of his comments supports the notion that he is in fact an employee.

Though, the situation could also demonstrate Lineker’s freedom given that he was able to express thoughts that evidently broke the impartiality rules of company guidelines, suggesting he works outside the regulations of a normal salaried worker.

Vitally, if he were a suspended employee, then he’d still be likely to receive payment during his downtime. The fact of there being no mutuality of obligation for the BBC to provide him with work or pay him, nor was their expectation for Lineker to do work in return, could be a blow to HMRC’s case against Lineker.

This case is more complicated than others we’ve seen due to the ‘in partnership’ way of working that Lineker has established with the BBC. It will be interesting to see how things conclude and whether a new precedent is set.

It’s a difficult case to call the shots on without all the detail in the contracts, but it clearly shows the ever-murky waters of IR35 compliance under the current legislation.